Insights

Insights

AI Everything: The Rise of Artificial Intelligence in Commercial Real Estate

July 2, 2023

Server Room © 2023 Adobe

The Rise of AI

AI has captured the world’s imagination. ChatGPT, DALL-E, and other generative artificial intelligence (AI) tools have garnered public interest and made countless headlines in recent months. While generative AI has been under development for years, recent advancements in the underlying machine learning and deep learning capabilities have paved the way for the language models and interfaces we’re seeing today.

Many notable new technologies thrive on emerging AI such as autonomous driving, live traffic maps, facial recognition, targeted advertising, and voice assistants like Alexa and Siri that will autonomously call your nearby hair salon to book your next appointment.

After a number of advancements, experts believe the future offers potential paradigm shifts in the way we think about computed-aided productivity. Andrew Ng, a renowned AI researcher and co-founder of Coursera, called AI “the new electricity,” while Google CEO, Sundar Pichai, described the possibilities of AI as “more profound than fire or electricity.”

Use Cases and Impacts Vary

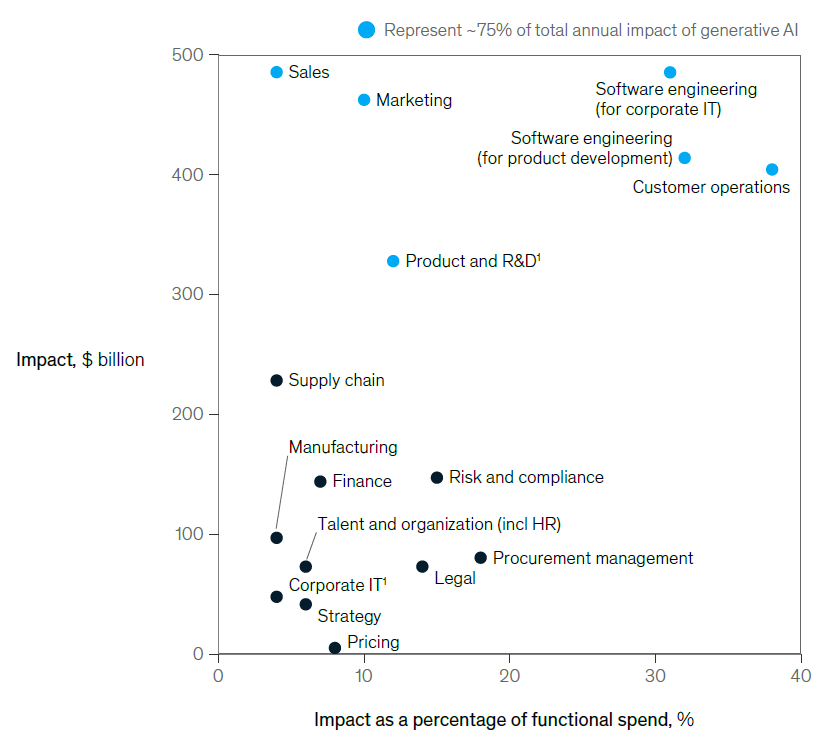

AI is a clear evolution across a wide spectrum of use cases which will certainly lead to disparate outcomes. The potential impact is likely felt most in the human-centric roles with repetitive tasks in large volumes. Initial research indicates AI boosts productivity in Customer Operations, Sales, and Marketing by up to 45%, with the potential for even greater enhancements in the future, potentially creating between $2.6 trillion to $4.4 trillion in value across industries and 63 use cases (McKinsey & Company).

AI also has enormous potential within new and existing applications. Microsoft and Mercedes-Benz recently announced a collaboration that brings beta functionality of OpenAI’s ChatGPT into Mercedes’ latest models. The move is an effort to differentiate the luxury manufacturer’s customer experience. By integrating AI algorithms and cloud computing, Mercedes-Benz will offer drivers an elevated voice command and interaction experience with expanded task capabilities and contextual follow-ups. A dinner reservation is just a “Hey Mercedes” away through the MBUX Voice Assistant system.

Applications can be obvious in certain industries, but others less so. The direct and indirect impacts on real estate are less clear, so we’re sharing some of our latest thoughts. We expect the outcomes to vary across product types, with potential headwinds brewing in certain asset classes while others may see great opportunities. AI technology will continue to change the landscape in unexpected ways; however, it’s clear to us that AI will enable investors to make better decisions, and will change both our need for space and also how we experience those spaces.

Generative AI could drive meaningful productivity across use cases

Source: McKinsey & Company, Comparative Industry Service (CIS), IHS Markit; Oxford Economics; McKinsey Corporate and Business Functions database; McKnsey Manufacturing and Supply Chain 360; McKinsey Sales Navigator; Ignite, a McKinsey database; McKinsey anlysis

Note: Impact is averaged.

Current Applications of AI within Prop-Tech

Venture capital investment in the property technology sector hit record highs in 2022, with more than $19.8 billion betting on the future of real estate related offerings (CRETI). While activity is down substantially in 2023, Prop-tech remains a growth vertical with the potential to drive ESG initiatives, optimize asset operations, enhance analysis and decision-making, and improve investment outcomes. Within the past few years, several prop-tech start-ups have brought new capabilities into the space and many of those tools are gaining wide adoption.

Firms such as PropHero launched with the ambition to make property investment simple, transparent, and time-efficient by using data, proprietary AI algorithms, and an online platform to offer an end-to-end property investment service. Another start-up, VTS is a leading leasing and asset management platform. Landlords use VTS to maximize portfolio performance by transforming their leasing and asset management process and providing real-time insights – enabling managers to convert leads to leases faster and build data-led strategies.

We approach these new technologies with cautious optimism. These systems are imperfect and can return biased or incorrect results, so a disciplined approach and measured use is appropriate.

The expansion of prop-tech will certainly continue and further influence the industry. Despite real estate’s very tangible and physical nature. Embracing AI can absolutely produce greater efficiency and improved experiences that have a real impact.

Read more on the current economic environment and the Fed’s mission of price stability in our previous article on considerations for investment in an inflationary period, or the challenges that face new home and apartment builders in our article on the mounting headwinds for the new supply pipeline.

Changing the Dynamics of Industrial Space

AI is already prevalent in a variety of ways within transportation and logistics. These powerful tools are improving the shipping process, delivery routes, time in transit, and distribution center efficiency leading to faster service speeds for retailers such as Amazon which, in turn, have increased consumer expectations. These tech-driven innovations have led to the rise of last-mile distribution strategies where goods are stored in smaller locations closer to the ultimate delivery address.

Tight labor markets and the growth of e-commerce have accelerated the industry’s search for machine alternatives. For nearly a decade now, AI has enabled the rise of Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs). These autonomous vehicles excel at quickly fetching items in high volumes and executing repetitive activities such as processing orders and moving goods. Robots can also work effectively in smaller spaces and within configuration constraints that would be impossible to replicate with a human workforce. According to Honeywell, a leading supplier of warehouse automation tools, distribution throughput is increased by 30% to 40% with these AI-driven improvements.

We anticipate the implementation of AI will continue to morph the landscape of industrial space and be a thematic tailwind for the sector. This shift to last-mile distribution and deployment of a more efficient robotic workforce changes tenant demand away from large, suburban bomber warehouses and into smaller, more urban-centric distribution centers.

Potential Headwinds Swirl for Office

The office market continues to battle a myriad of headwinds. Persistent work-from-home culture and a slowing economy have many investors hesitant to commit capital. Expectations vary widely between participants, as some investors are calling for continued pain while others are reinvesting into their assets. Capital Economics, a London-based research firm recently forecasted office values to fall an additional 35% by the end of 2025 and suggested they’d be unlikely to recover until 2040. In the report, Capital Economics attributes the dilution primarily to the remote work movement, citing a rise in hybrid work will see companies opting for less office space to accommodate a smaller in-person workforce.

Not everyone shares the same bearish view, but even the bulls are shifting strategy in light of the changing landscape. Vornado Realty Trust just announced a $1.2 billion capital commitment to two of its New York City office assets. Steven Roth, the firm’s chairman, penned a letter to investors where he labeled Friday office work as “dead forever” and Monday as “touch-and-go.” Vornado’s bet rests on combatting the trend by appealing to companies and workers with top-of-market, experiential office space that differentiates itself through unparalleled amenities such as connectivity to public transit, hotel-style lobbies, libraries, tenant lounges, and high-end restaurants, and even on-site medical care.

Elevated amenities may not be enough for many assets. A study by Microsoft suggested 85% of remote workers believe they are equally as productive at home, while just 12% of managers agree. Companies may opt to automate high-volume tasks in an effort to boost productivity, reducing the number of human workers necessary and ultimately reducing the amount of office space needed to operate. AI’s ability to improve productivity, particularly in human-centric fields that traditionally require large blocks of office space, could become a real headwind to the asset class.

Improving Multifamily Operations

Residential offers particularly interesting applications for AI in areas such as ESG implementation, asset preservation, marketing, and resident experience. The COVID-19 pandemic spurred the adoption of AI-backed leasing technologies such as automated leasing assistants and self-guided tours. These platforms increase the effectiveness of an investment’s marketing efforts by leveraging data to provide better reach and accelerate the leasing process.

We’re also seeing the emergence of AI-powered services such as predictive maintenance optimization, smart home connectivity, and package management tools – all of which aim to drive efficiency by lowering operating costs and increasing resident satisfaction.

As prop-tech matures, we expect consolidation to bring these emerging technologies under the umbrella of the largest property technology ecosystems and offer all-in-one building management systems.

Creating a Differentiated Resident Experience with AI

Many of today’s latest tools will become industry standard, with leasing assistants and self-guided tours being chief among them. The economics are too compelling to ignore. However, we believe an area of great opportunity for AI is to improve the resident experience.

Imagine living in a property with an AI-powered virtual concierge available to assist you 24/7, providing personalized support and recommendations. They assist with building inquiries; maintain amenity access like gyms, studios, and community spaces; help schedule maintenance requests; or even coordinate your household needs by communicating access instructions directly to a delivery driver or service provider. Those are just a few ways AI can potentially improve residents’ living experiences.

Managers could build a sense of community by evaluating individual and community preferences and behavior patterns. AI can use this data to provide customized recommendations for events or services that align with resident interests and lifestyle choices. The virtual concierge could analyze and offer personalized recommendations for local activities such as nearby live music, charity events, or retail sales – all based on individual preferences.

Advanced AI tools such as facial recognition could create safer, more secure environments through access control, identifying anomalies in behavior, and recognizing unauthorized individuals, ensuring enhanced security for the entire community.

Similar to how Microsoft and Mercedes-Benz are innovating the luxury car experience, AI offers a compelling opportunity to create competitive advantages within the residential asset class by differentiating the residents’ experiences. Improving the leasing process, elevating the resident lifestyle, and building a tight knit community are effective ways to differentiate an asset and compete for traffic in ways others cannot – driving demand and ultimately investment outcomes.

We are in the midst of a technological evolution with both direct and indirect impacts and applications throughout the real estate sector. With extensive experience and boots-on-the-ground insight, Hughes Capital Partners can identify the risks and opportunities of AI on our industry and our investments, and adapt to the future of AI in commercial real estate.

Hughes Capital Partners is a real estate investment firm focused on delivering institutional-caliber investment opportunities, strategy, and execution to qualified investors. With deep real estate experience across 115 assets and over $6.6 billion of investment activity, Hughes Capital Partners offers a proven track record in key markets throughout the nation. Connect with our team or complete our investor questionnaire to learn more.

Related Insights

Signal Intelligence: Navigating Private Real Estate by Leveraging the Public Markets

The public markets frequently offer valuable insights to private market investors, serving as a crucial predictor of what lies ahead.

Statement regarding unaffiliated Hughes Private Capital, a Nevada-based firm

(DALLAS – July 3, 2023) Reno-based Hughes Private Capital, Inc. is not affiliated with Hughes Capital Partners, LLC (“HCP”) or any HCP investments.

Apartment Supply Constrained by Mounting Headwinds

Higher interest rates are intended to cool today’s demand but are strangling tomorrow’s supply. Interest rates, construction costs, and illiquidity are among today’s development challenges.

Start the Conversation

Committed to delivering institutional-caliber investment opportunities, strategy, and execution.