Insights

Insights

Signal Intelligence: Navigating Private Real Estate by Leveraging the Public Markets

January 4, 2024

Since the turn of the Global Financial Crisis (GFC), real estate investors have enjoyed the sector’s attractive yields and dominant tailwinds such as the lowest interest rate environment in history, generational demographics shifts, wide-spread shortage of attainable housing, and changing occupier preferences. However, as the saying goes, “all good things must come to an end,” and the sector’s recent rising tide has certainly met its inevitable finale. With the successes of the last cycle now squarely in the rearview mirror, investors are searching for clarity in what have become very muddy waters.

The public markets often provide “signal intelligence” for private market investors through the commentary and actions of public market players, and the speed with which changing environments are priced into the shares – often key indicators for what lies ahead for the sector. Today, we discuss the compelling dynamics between the public and private real estate markets and share our insight into these critical considerations.

Relevancy of the Public Markets

Gaining exposure to real estate is in achieved two ways – the public markets through publicly traded REITs, and the private markets typically through private placements. While the two may offer similar exposure to the underlying asset class, the volatility within the public market is a key differentiator and both a benefit and a detriment.

That level of volatility is the impetus for why the public markets are relevant for private investors. The speed with which information can be evaluated and factored into the value of the shares is vastly superior to the much slower moving private markets. As such, the public markets can often serve as a barometer for future performance – a window into the potential future.

Historically, there has been a clear relationship where public REITs often precede changes in private market performance. Data provided by Green Street, a leading commercial real estate research firm, suggests that for 96% of the time between 1998 and 2018, property prices have appreciated within the 12 months following periods where public REIT shares traded at a premium to their net asset value (NAV). Furthermore, the inverse was also true when REITs traded at a discount to NAV.

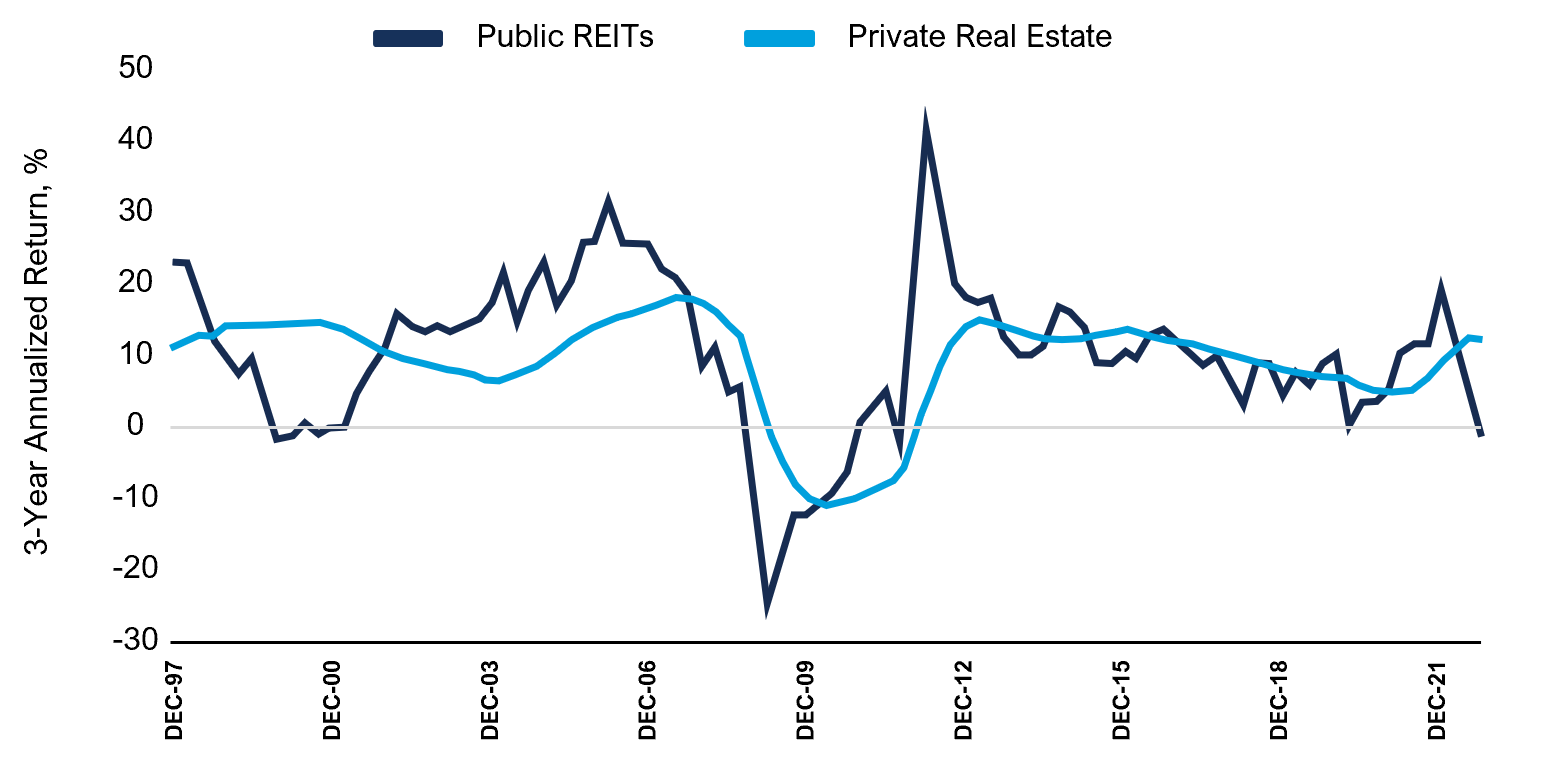

Public and Private Real Estate Returns

3-Year Annualized Returns

Source: Janus Henderson Advisors, Morningstar Direct, Public REITs: FTSE Nareit All Equity REITs TR USD, Preivate REITS: NCREIF Fund ODCE, January 1, 1995-September 20,2022

In research provided by NAREIT, the National Association of Real Estate Investment Trusts, REIT valuations tend to lead the private market by 6 to 18 months. This relationship was particularly evident during the first months of the GFC and again during the COVID-19 pandemic where volatility in the market made the pricing discrepancy more pronounced.

Further, analysis completed by Janus Henderson Advisors, a global asset manager, found that public REITs and private real estate are highly correlated when adjustments for time are made, as shown in the chart above. When adjusted for time, REIT values have a correlation of 0.84 with the private markets.

Interpreting the Disparity

Curiously, if we evaluate today’s pricing of the public markets, we again see a disconnect. According to Green Street, apartment REITs are valued at an implied mid-6% cap rate. In comparison, some private market transactions are clearing in the mid-5% range, representing an approximate 100bps spread.

In November, publicly listed REITs traded at a median discount of 20%, an improvement from a 28% discount the previous month, according to S&P Global Market Intelligence data. Since then, the public market’s year ending bull run has moderated the disconnect for some asset classes. The valuation discrepancy between the two markets saw improvements in December, with apartment REITs pricing roughly 11% below the private markets, office REITs discounted 13%, lodging REITs discounted 14%, and SFR REITs discounted 17%.

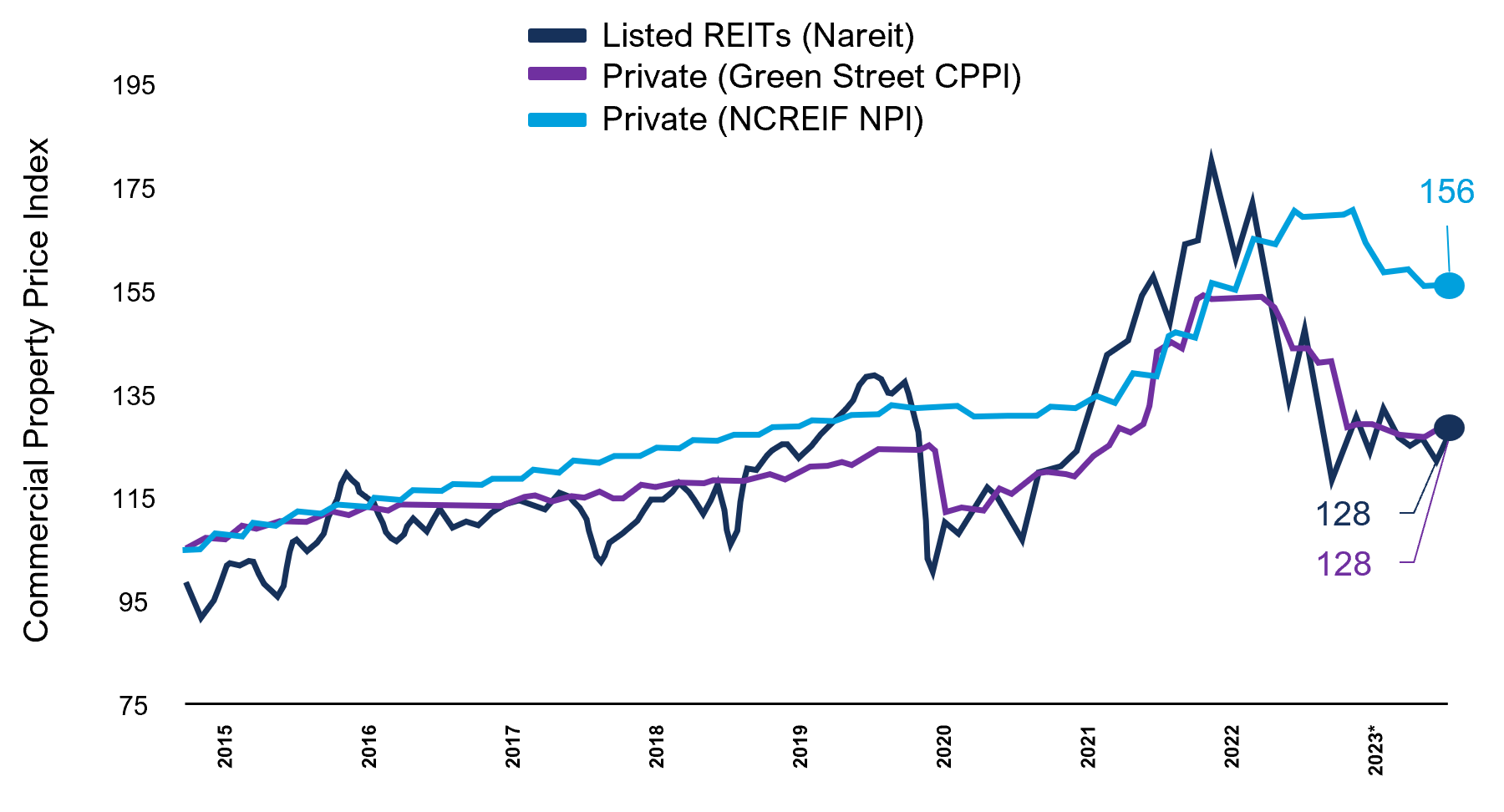

Public and Private Real Estate Prices

Indexed to 2015 = 100

* as of June 30, 2023

Source: Bloomberg, NCREIF, Green Street

Gaining insight from these signals requires an understanding of the forces that shape the price discrepancy. Private investors can begin by looking at the commentary of REIT leadership. Sentiment from the annual industry gathering, NAREIT REITWorld, felt cautiously optimistic. While the US economy continues to show strength, a “soft landing” has become a recurring talking point. REIT investors have largely been risk-off over the past year, cautiously on the sidelines until market conditions offer more stability. Greater stability provides a higher level of confidence in future performance – both at the asset level and within the capital markets. Achieving stability is easier said than done. A key source of instability has been the delicate dance between elevated inflationary pressures and the Fed’s counterpunch of higher interest rates. The inflationary pressures have largely been a tailwind for income statements contributing to strong rent growth, but higher interest rates are a formidable risk to vulnerable balance sheets.

The Fed’s mission of price stability naturally brings a lower growth environment and a sense of soberness toward operating fundamentals. A sentiment that is shared both in person at REITWorld and through the quarterly reports of many listed REITs. Recent executive commentary has warned that fundamentals are slowing, and leadership feels the need to preserve capital and focus on appropriately managing firm balance sheets. REITs typically have access to the most efficient capital structure within the sector, thus providing greater protection from balance sheet failures while the private markets are substantially more vulnerable to rising rate environments.

Explore relevant insights from Hughes Capital Partners

Read more on the current economic environment and the Fed’s mission of price stability in our previous article on considerations for investment in an inflationary period, or the challenges that face new home and apartment builders in our article on the mounting headwinds for the new supply pipeline.

The private markets react much slower to changing conditions, which is evident in the current environment. Valuation multiples become difficult to measure in the private markets as transaction volume often freezes overnight, thus market clearing values become difficult to triangulate, if they exist at all. Expensive equity, lack of available and affordable debt, and wildly inconsistent future expectations drive the bid-ask spread further apart. Sellers continue holding on to yesterday’s values while buyers price in the worst-case scenario.

Over the past year, average values have been diluted by ~20% from their prior peak, with some asset classes suffering greater declines such as office assets, down ~35%. Undercapitalized private market investors are facing loan maturities on assets that generate too little yield to sustain current interest rates. This scenario effectively leaves the investor underwater with few, if any, palatable choices. Eventually, and with enough pressure and few options, owners with vulnerable balance sheets will be forced to capitulate at market clearing prices – which have yet to be established with any real certainty. Reconciling the difference between the liquid public markets and the largely frozen private markets is the key to extracting value from these signals.

Crosswinds are Swirling, Private Markets Should Heed Caution

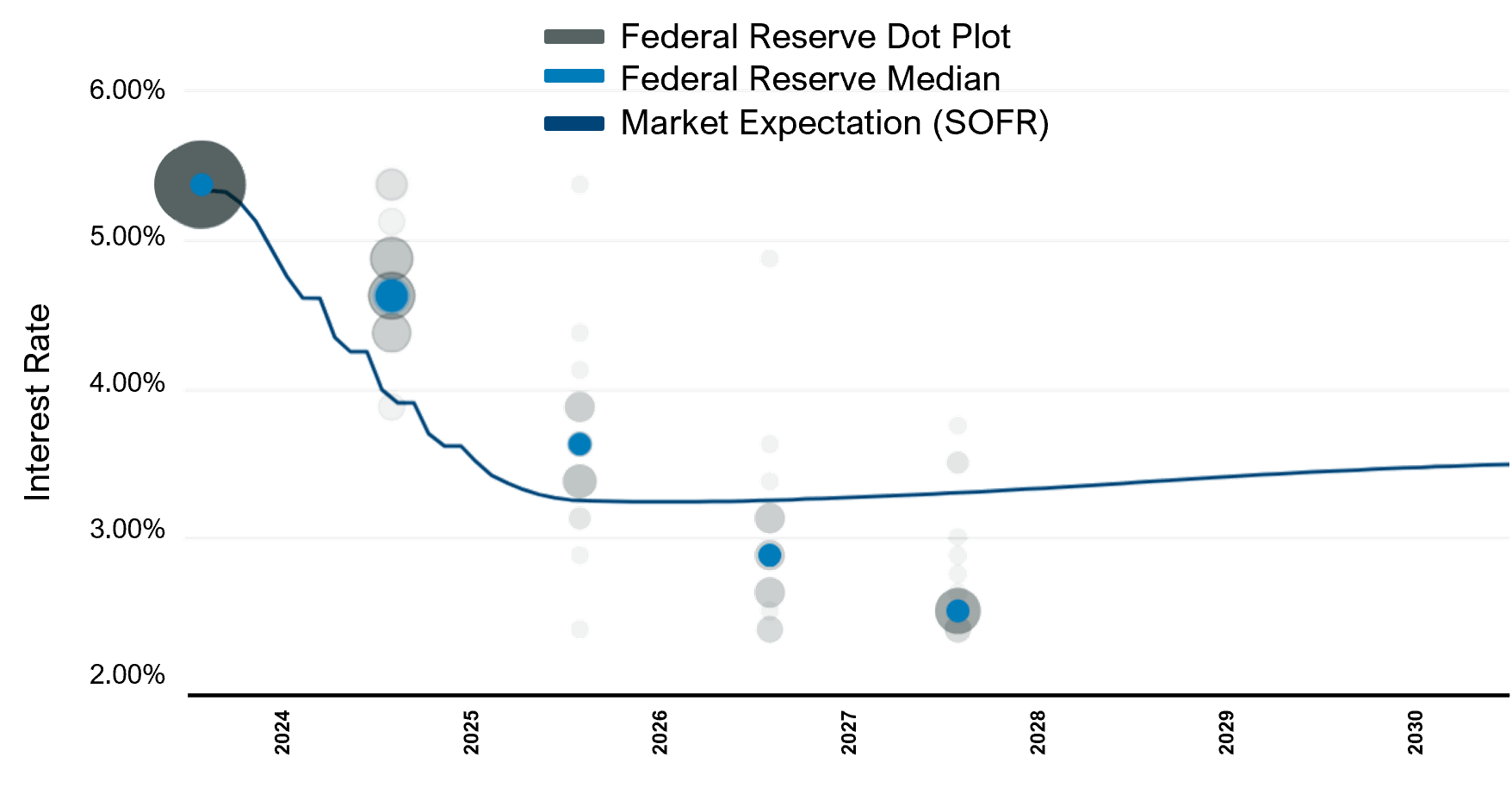

Interest Rate Pricing Expectations

Federal Reserve Participant Survey Versus Market Expectations

* As of January 4, 2024

Source: Chatham Financial, Federal Reserve Projections

A forceful crosswind would be a more dovish tone from the Federal Reserve and a shift toward lower rates – but any real indication of that has yet to materialize from the Federal Reserve. Despite a consistent message from Jerome Powell that rates will stay higher for longer, the markets have demonstrated an expectation that the recent downward trajectory of inflation will merit rates cuts sooner – which would be a positive influence on asset values.

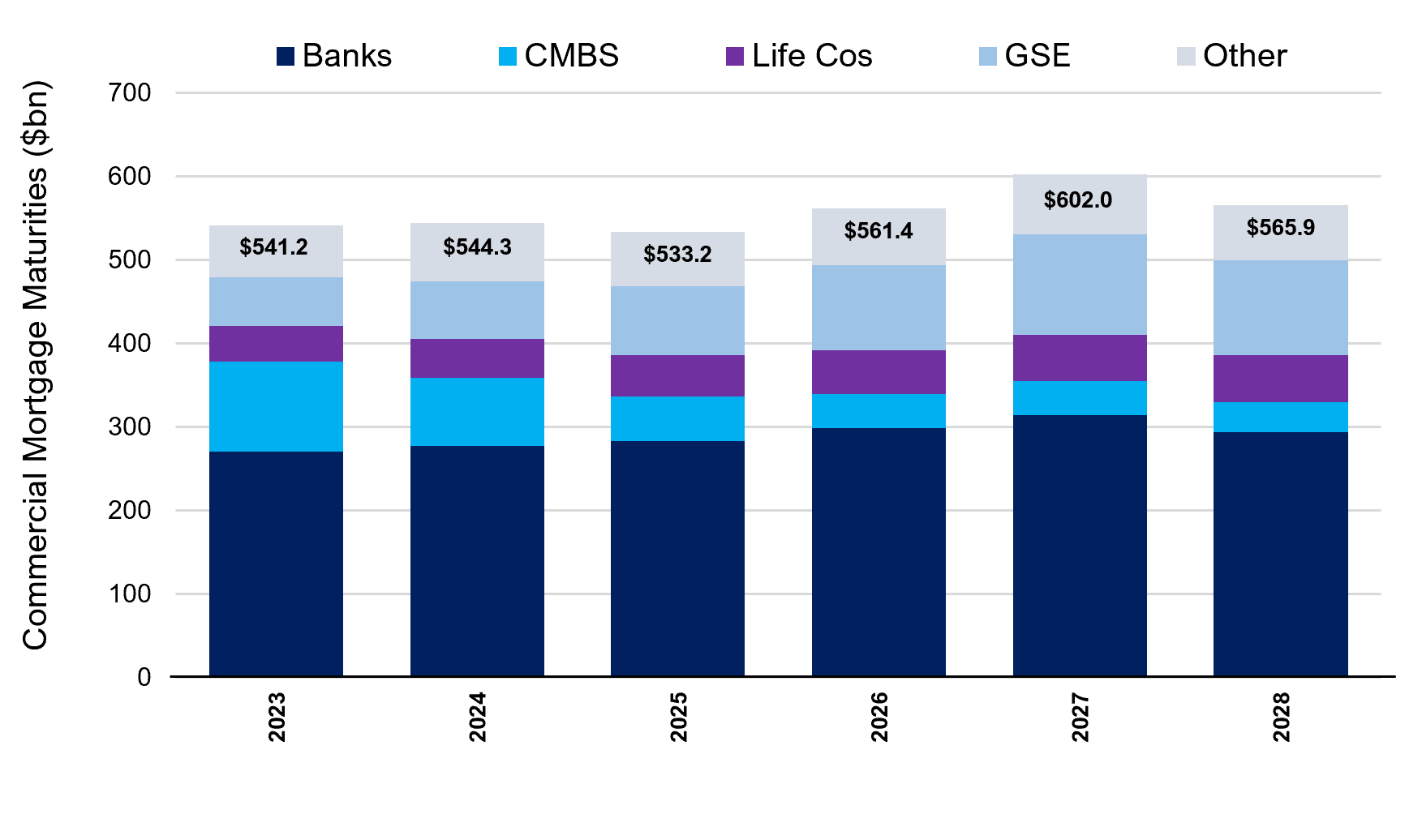

While the idea of potential rate cuts may excite some investors, others caution looming debt maturities will pressure sellers toward lower market pricing. More than $544 billion of commercial mortgages will come due in 2024, according to data compiled by Trepp. Nearly half of the $5.67 trillion of outstanding commercial mortgages will mature by 2027 – $2.08 trillion backed by residential assets. More loans will mature in 2024 than any other calendar year since 2013. While many of these loans will be restructured, the pure volume of maturities suggests many owners will be forced into the market at the prevailing price – a downward pressure on asset values.

Commercial Mortgage Maturities

Annual Maturities by Lender Type ($ Billions)

Source: Trepp Inc., based on Federal Reserve Flow of Funds Data

Investors must ask themselves: Have the public markets oversold REITs, or are private markets yet to capitulate? Time will tell. The material disconnect between the public and private markets suggests we’ll continue to see valuation multiples move until the dust settles and a new equilibrium is found. With deteriorating operating fundamentals, unattractive financing options, and growing pressure on sellers to move assets, additional value declines in the private market seem to be an almost certain reality. If that happens, the public markets will once again prove to be a relevant signal for the private market.

Investors seeking to capitalize on the recent valuation reset should follow the lead of the public markets and proceed cautiously with prudent conservatism. Given the current environment and notable crosswinds in play, we believe that the conditions exist for compelling opportunities within the private market to materialize over the coming months. We also remain encouraged by the medium and long-term tailwinds supporting investment in the sector.

Sign up to receive our latest insights and ideas directly to your inbox by subscribing to HCP Insights.

Interested in learning more about Hughes Capital Partners or our investment strategies? Connect with our team today.

Learn more about Hughes Capital Partners

Hughes Capital Partners helps our clients navigate the complex world of private real estate investment by offering a proven record of identifying risks and opportunities and providing valuable insights to make informed investment decisions. Through an active, boots-on-the-ground approach to investing, Hughes Capital Partners adapts to the ever-changing landscape and provides actionable strategies to achieve your financial goals. Connect with our team to learn more.

Related Insights

Statement regarding unaffiliated Hughes Private Capital, a Nevada-based firm

(DALLAS – July 3, 2023) Reno-based Hughes Private Capital, Inc. is not affiliated with Hughes Capital Partners, LLC (“HCP”) or any HCP investments.

AI Everything: The Rise of Artificial Intelligence in Commercial Real Estate

In the midst of groundbreaking advancements in technology, we discuss impacts and applications of AI within commercial real estate.

Apartment Supply Constrained by Mounting Headwinds

Higher interest rates are intended to cool today’s demand but are strangling tomorrow’s supply. Interest rates, construction costs, and illiquidity are among today’s development challenges.

Start the Conversation

Committed to delivering institutional-caliber investment opportunities, strategy, and execution.