Insights

Insights

Apartment Supply Pipeline Constrained by Mounting Headwinds

March 30, 2023

Apartment Construction © 2022 Adobe

The housing shortage is a leading driver of today’s affordability challenges and continues to bolster inflationary pressures

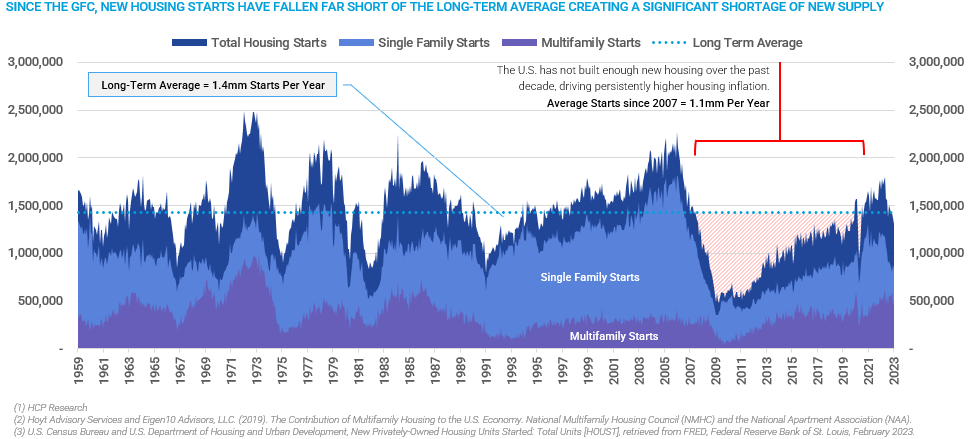

Since 1959, US housing starts have averaged more than 1.4 million new homes and apartments each year. Rising tensions and a distinct memory of the pain felt during the Global Financial Crisis (GFC) has anchored US housing starts around just 1.1 million new units per year since 2007, leaving a growing need for new housing. This gap between new construction and new household formation grew to 6.5 million between 2012 and 2022, creating a housing shortage. In 2021, housing prices appreciated at a historical pace, propelled by cheap debt and heightened personal savings rates which gave new prospective homeowners the ability to buy for the first time, and allowed current owners to trade into more expensive homes or neighborhoods. The surge in demand drove housing prices to new heights and contributed to the inflationary environment we find ourselves in today. Despite the incredible demand seen since the COVID-19 pandemic, headwinds are mounting for developers and leave no end in sight for the housing shortage as high construction costs, rising interest rates, and the illiquidity of capital leaves the new supply pipeline frozen.

The Federal Reserve continues the tightening cycle in search of price stability

Over the past year, the Federal Funds rate rose faster than any other cycle in the past four decades – jumping from 0.0% to 5.0% in 12 months. Fortunately, the Fed’s efforts are paying off as signs of a cooling economy are beginning to emerge with core inflation declining to 6% in February, down from a peak of 9% in July 2021. Areas of distress are also evident in light of the recent turbulence in the banking sector, influencing the market’s expectation that the Fed’s inflation-fighting rate hikes will reach a low-5% terminal rate by the summer of 2023.

Read more on the recent increase in inflation and the Fed’s mission of price stability in our previous article on considerations for investment in an inflationary period.

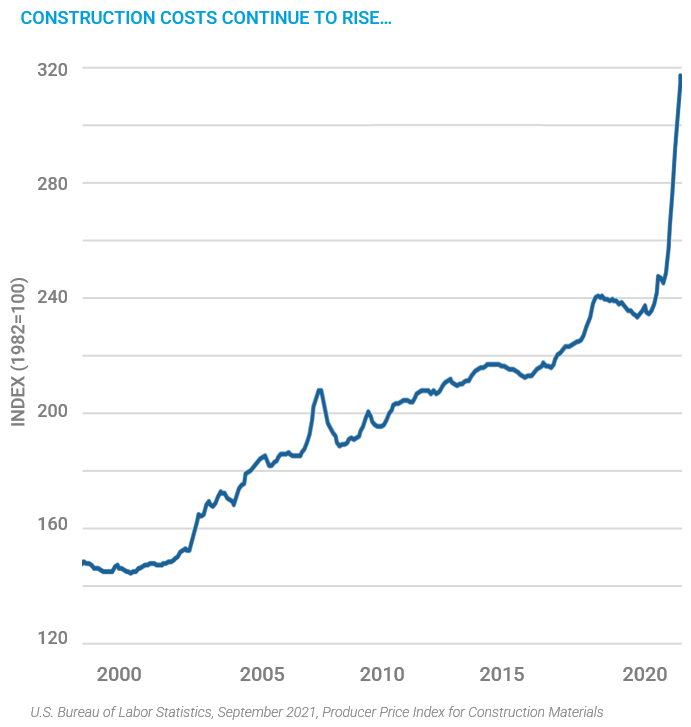

Skyrocketing construction costs make new development more difficult, less appealing to investors

Since 1982, construction costs have increased by 320%. Perhaps more concerning to housing developers is that 80% of those increases happened since the onset of the pandemic, primarily due to global supply chain interruptions. As construction costs rise, it becomes more costly than ever to develop new housing with fewer and fewer opportunities worth the risk of investment.

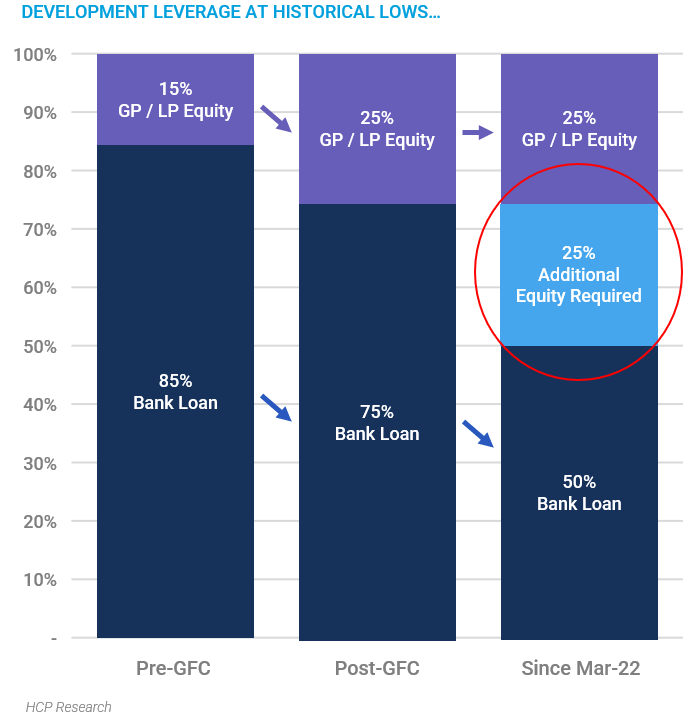

While development costs are rising, high volatility and previous experience during the GFC have a significant influence on advance rates and lending standards

Past losses affect a bank’s perception of risk for future development projects during turbulent periods. Those past experiences have led to lending standards tightening greatly since the last time the US experienced a material economic disruption. Looking back at the height of the last cycle, oversupply and crumbling demand left financial institutions in turmoil, which they remain scarred from today. As a result, we’re seeing higher risk premiums, tighter lending standards, and lower advance rates for new projects.

In the aftermath of the GFC, banking regulators across the globe drafted more stringent frameworks to improve bank capitalization. The Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank) and other international measures were developed to improve the stability and resilience of the banking system by increasing the amount of capital that banks are required to hold, setting new liquidity requirements, and strengthening risk management practices. Key provisions of both frameworks include limitations on the amount of debt a bank can take on relative to its capital and required additional reserves for construction lending to cover potential losses, which reduces a bank’s lendable assets and causes construction loans to be considerably more expensive for the bank today than prior to the GFC.

Liquidity is declining for many construction lenders as reserve balances in focus and deposits dwindle

Banks lend against their held deposits and compete for those deposits against other “risk-free” alternatives such as US treasuries. With an inverted yield curve and short-duration treasury rates reaching 5% (UST 6M), some of those deposit dollars are shifting from bank accounts and into treasuries, limiting the amount of capital available to lend and creating liquidity risk for the banking system.

Fears surrounding the stability of the global banking system are mounting and accelerating the shift into treasuries. Silicon Valley Bank and Signature Bank NY represent the second and third largest bank failures in US banking history, following only the failure of Washington Mutual with $307 billion of assets in 2008. US banks are not alone. Credit Suisse recently received a $50 billion loan from the Swiss National Bank before a reported sale to UBS to shore up liquidity concerns and stabilize one of the world’s largest banks. The Swiss bank started in 1856 and is best known for its large wealth management platform and for its leading investment bank and asset management business, demonstrating that investors’ concerns stretch beyond the shoulders of select regional banks and instead across the entire global financial system.

The elevated perception of risk, greater loan requirements, and fleeting deposits mean the debt markets are strained – resulting in lower loan proceeds at a time when construction costs are near all-time highs, requiring significantly more equity to develop new housing

Prior to the GFC, borrowers were able to secure 85% loan-to-cost debt which required 15% equity. The implementation of tighter loan constraints then allowed borrowers to secure 75% of total costs in debt, increasing the equity commitment to the remaining 25%. In today’s environment, underwriting standards are constricting banks to 50%, expanding the equity requirement to 50% almost overnight, often more equity than the developer has available and therefore forcing many projects to the sidelines. Consider a $60 million development project that was once capitalized by a $51 million loan along with a $9 million cash investment. Today, that same project would require $30 million of equity, effectively 2.3 times the amount of cash needed prior to the GFC, and 2.0 times the $15 million equity investment needed just a year ago.

Large investors are pulling back, leaving a lack of capital to fill the gap

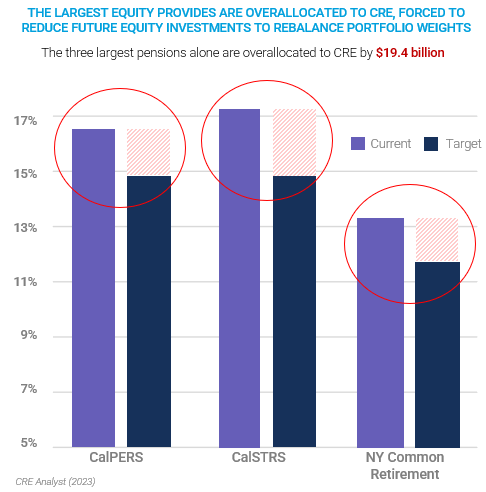

Making matters worse for developers, many of the country’s largest pensions and insurance companies, which provide an enormous amount of construction equity, are now on the sidelines due to the so-called “denominator effect.”

Institutional portfolios allocate based on modern portfolio theory, where asset classes are assigned target weights based on an investor’s risk tolerance. These target allocations can be thought of as a simple fraction, with the amount of capital allocated to the asset class as the numerator and the total portfolio value as the denominator. The rapid change in values seen in 2022 was impactful across the risk spectrum, specifically impactful in volatile public equities and fixed income markets, leaving many institutions overweight in real estate. The severity of the denominator effect can be seen by looking at the three largest pension funds, currently overweight in real estate by a combined $19.4 billion, according to CRE Analyst.

Rebalancing the portfolio may require the liquidation of existing assets or shifting new capital elsewhere – effectively removing equity from the real estate markets.

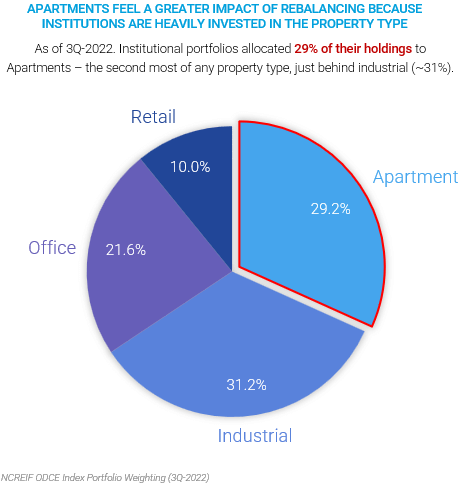

Based on the ODCE Index, 29% of institutional dollars are currently allocated toward residential opportunities. The NFI-ODCE index is an index of the largest private real estate funds and, therefore, a proxy for the allocation of institutional dollars invested into the apartment space.

Given the necessity of such a significant reweighting, we expect to see fewer institutional developments break ground and a lower volume of investment activity. In fact, there is more transaction activity from smaller private buyers than the largest institutional investors for the first time on record. According to a Knight Frank Global Wealth Report, private investors accounted for 41% or $455 billion of the total real estate transactions in 2022 whereas institutional transaction volume totaled $440 billion.

Fewer starts will further strain housing affordability and fuel demand for rentals

The current lack of available debt and substantially higher equity requirements at a time when the largest equity providers are on the sidelines will result in less development activity. The inability to break ground on a sufficient number of new units will only add to the strain on housing affordability, especially in markets like Texas, Florida, and California which, according to a report by the National Multifamily Housing Council and National Apartment Association, will account for 40% of the future housing demand.

The impact of this environment will be felt in 2025 and 2026 when today’s projects would have been slated for delivery. Although, the impact will emerge first in the single-family market as inventory lead times are considerably shorter, allowing builders to adapt quickly to shifts in the cycle.

As the headwinds are mounting, we anticipate fewer units will break ground over the coming year, further exacerbating the housing shortage and continuing to intensify affordability challenges in growth markets where migration patterns exceed the new supply pipeline. Looking forward to 2025 and beyond, projects under construction today will have been delivered and will likely be stabilized, and the number of new projects will be insufficient to meet the need for rental housing.

Investors should seek opportunities that provide clear downside protections from the current risk environment and are positioned to benefit from potential changes in market conditions. With key relationships built upon our extensive experience, Hughes Capital Partners is well-positioned to identify and capitalize on market trends throughout economic cycles. We believe opportunities continue to exist in this environment by leveraging demographic and economic tailwinds viewed through a lens of actionable insights, and a thoughtful approach to risk.

Learn more about HCP and our strategies, connect with us today.

Hughes Capital Partners is a real estate investment firm focused on delivering institutional-caliber investment opportunities, strategy, and execution to qualified investors. With deep real estate experience across 115 assets and over $6.6 billion of investment activity, Hughes Capital Partners offers a proven track record in key markets throughout the nation. Connect with our team or complete our investor questionnaire to learn more.

Related Insights

The Rise of Private Credit in Commercial Real Estate

Since late 2021, the commercial real estate (CRE) industry has experienced profound shifts caused by rising interest rates, constrained liquidity, and changes in investor strategies.

Hughes Capital Partners Advises Single-Family Office in Acquisition of Oklahoma City Apartments

Hughes Capital Partners is proud to announce the successful acquisition of The Pointe at North Penn on behalf of a single-family office.

Signal Intelligence: Navigating Private Real Estate by Leveraging the Public Markets

The public markets frequently offer valuable insights to private market investors, serving as a crucial predictor of what lies ahead.

Start the Conversation

Committed to delivering institutional-caliber investment opportunities, strategy, and execution.