Investor Resources

Private Real Estate for Individual InvestorsEducation

Understanding Returns: Diving into the Details of IRR

For investors, the idea of return can be measured through various metrics. One particularly prevalent metric is the Internal Rate of Return (IRR), which is frequently referenced for its ability to capture both the magnitude and timing of returns. Yet, not all IRRs are created equally.

Delving into the components that drive IRR – distinguishing between returns from cash flow and returns from exit proceeds – empowers investors to pinpoint the source of their returns and assess the risk associated with those sources. Below, we’ll discuss why investors should understand the drivers of IRR, provide illustrated examples, and discuss how investors can utilize the analysis on future opportunities.

Understanding IRR

The Internal Rate of Return, in its simplest form, is a metric used to evaluate the attractiveness of an investment opportunity in comparison to other alternatives. It does so by discounting all future cash flows at the project’s required rate of return to arrive at a single rate of return. IRR is highly versatile – it can be equally effective in comparing different investments with the same time horizon or in determining the net benefit of a single asset.

Calculation Methodology and Interpretation

To calculate the IRR of an investment, it is necessary to solve for the discount rate that makes the present value of the future returns equal to the initial investment. A higher IRR signifies a more lucrative investment. However, sole reliance on IRR does have its limitations, especially when comparing projects of different durations and scale, which makes understanding the bifurcated IRR all the more invaluable.

Bifurcation of IRR

The bifurcated IRR is a visualization that dissects the overall IRR into various components. Two key components are the percentage of return derived from cash flows during the holding period of the investment (operating yield), and the percentage of return derived from the net cash flows that occur at the end of the investment (capital yield), usually stemming from the asset’s sale.

This analysis offers investors a deeper understanding of return sources and sheds light on the inherent investment risks. By comprehending the origins of returns, investors can make informed choices, especially when evaluating the risk associated with those sources compared to alternative opportunities.

Real Estate Perspective

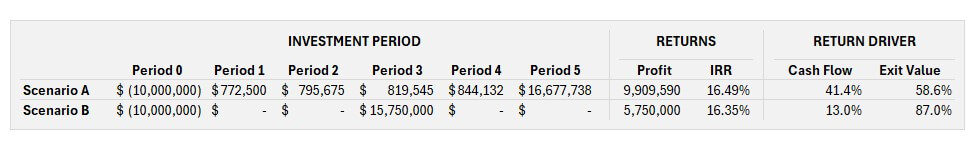

Consider two real estate investment scenarios to illustrate the value of the analysis:

In Scenario A, an investor renovates a $10 million apartment building, increasing rental income annually. In the fifth year, the property is sold for $15.8 million, yielding an overall IRR of 16.49%. Here, 41.4% of the IRR is generated from cash flows during the holding period, while 58.6% comes from the sale.

In contrast, Scenario B involves the development of a new apartment complex with a similar total cost and IRR. However, the investment matures over three years, with the project being sold for $15 million. Despite the similar IRR, the capital and operating yields are vastly different, shedding light on the risk and reward profiles of each investment.

Scenario A is generally perceived as less risky for several reasons, suggesting that Scenario B should theoretically yield a higher return for the investor. Although both scenarios have similar IRRs, Scenario B managed to recoup the initial investment within three years compared to five years for Scenario A. Consequently, Scenario B delivered a lower nominal profit of $5.75 million, in contrast to the $9.90 million profit from Scenario A.

This example underscores the value of delving deeper into a stated IRR. By analyzing the distinct drivers of return associated with each opportunity, one can gain valuable insights into their potential outcomes and implications.

Conclusion

Navigating potential investments against various opportunities can be challenging. Understanding the drivers of IRR allows investors to quantitatively assess their projected gains, while empowering them to make more nuanced appraisals of potential risks and returns.

Sign up to receive our latest insights and ideas directly to your inbox by subscribing to HCP Insights.

Interested in learning more about Hughes Capital Partners or our investment strategies? Connect with our team today.

Learn more about Hughes Capital Partners

Hughes Capital Partners helps clients navigate the complex world of private real estate investment. With a track record of effectively identifying risks and opportunities, we offer valuable insights to guide informed investment decisions. Our proactive, hands-on investment approach enables us to adapt to the dynamic landscape and deliver actionable strategies to help you reach your financial objectives. Connect with our team to learn more.

Related Education

Diversify Your Real Estate Portfolio

Investing in private commercial real estate (CRE) can offer numerous benefits; however, these investments carry risk. An essential aspect of mitigating these risks lies in the strategy of diversification and thorough due diligence.

Adding Real Estate to Your Portfolio

In today’s unpredictable markets, diversification is key. More than just a buzzword, diversification is a potent strategy that savvy investors employ to mitigate risks, and where better to start broadening your investment horizon than with real estate.

The Multifamily Housing Market

Multifamily housing, a key aspect of real estate investment, has been especially significant in the property market. It accounts for almost 25% of the U.S. commercial real estate market.

Start the Conversation

Committed to delivering institutional-caliber investment opportunities, strategy, and execution.