Investor Resources

Private Real Estate for Individual InvestorsEducation

The Risks of Private Real Estate Investment

Real Estate, like all investments, is exposed to a range of risks; however, not all risks are equal in their impact. Due to these variations in risk, deciding between investment options based purely on certain return metrics is difficult. Such a comparison can only be made if we assume that the risk associated with the investments under review is uniform. This post discusses methods for identifying risks that enable a thorough comparison of different options. We begin by briefly exploring the sources of risk and how they can differ among investment choices.

Comparing Investment Returns

Investors must carefully assess multiple risks when comparing the investment yields of a specific real estate investment against those of alternative real estate or various other investment options.

After conducting a comprehensive analysis of a potential investment and estimating an expected return, the investor must determine whether the investment will yield a satisfactory or competitive return relative to the associated risk. This determination depends on various factors, including the characteristics of the subject real estate, alternative investments available to the investor, the respective returns expected from those alternatives, and variances in risk between the investment under consideration and the alternatives.

When comparing asset classes, significant differences in risk become apparent. For example, certain asset classes show less variability than others (e.g., Treasury bills are often considered risk-free). It is plausible for assets in one category to present more risk than some assets in a higher-risk group. For instance, certain bonds may involve more risk than certain stocks, even though stocks are typically seen as riskier than bonds.

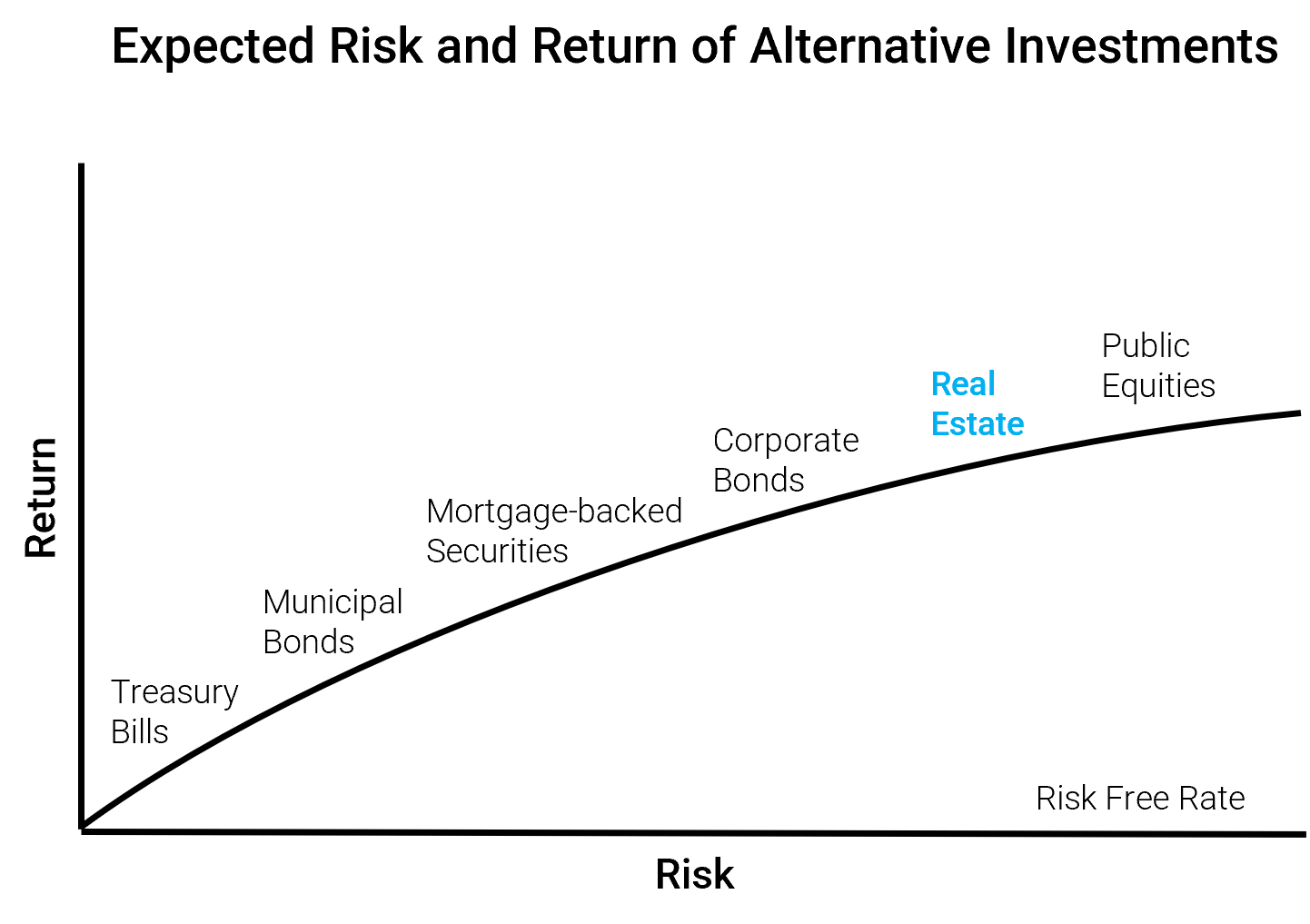

To aid in this analysis, picture a theoretical chart showing the relationship between return rates and risks for various types of alternative investments. The vertical axis represents the expected after-tax return, while the horizontal axis reflects the inherent risk level linked to each investment category. Risk is evaluated solely within the realm of investment classes in comparative terms; moving right on the axis indicates higher risk, while moving left suggests lower risk. Hence, investments carrying higher risks are anticipated to yield superior returns for investors, positioning them at a higher level on the Y axis; conversely, those with lower risks would be situated lower on the same axis.

According to this theoretical chart the security with the lowest return, U.S. Treasury bills, also holds the lowest risk. Treasury bills are devoid of default risk, although they are exposed to some interest rate and inflation risks. Progressing along the risk-return line in the illustration, we observe that projected pre-tax returns on real estate investments should offer significantly higher expected returns but entail much greater risk compared to investing in U.S. Treasury bills.

Types of Risk

Real estate exhibits distinct investment characteristics that elevate its risk profile compared to government securities. Additionally, real estate investment possesses unique risk attributes that set it apart from alternatives like common stock, corporate bonds, and municipal investments. Exploring the origins of these risk differentials across investment categories is essential. Let’s discuss several key risk factors that are vital for investors to consider when assessing various investment opportunities.

Market Risk: Changes in the real estate market, such as local economic conditions and supply and demand dynamics, wield a significant impact on property values and rental income. Real estate investors often prioritize market risk, influencing cash flow and property valuations. Diversifying a real estate portfolio by location, property type, and investment strategy can mitigate market risk. Economic conditions may differentially affect properties based on type, location, and leases. Variances in growth rates across regions and cities stem from demand and population shifts. Properties at higher risk face greater vulnerability to these fluctuations. Properties with diverse tenant mixes are less susceptible to business risk, while leases with safeguards against expense changes help alleviate business risk. In-depth research and analysis that ultimately provide a thorough understand of the market and it’s demand drivers is one form of mitigation for market risk.

Liquidity Risk: Real estate has a notable degree of liquidity risk, much higher than publicly traded alternatives like REITs. This risk occurs when the market lacks enough buyers and sellers to facilitate timely transactions, increasing the difficulty of liquidating an investment. The more difficult an investment is to liquidate, the more downward pressure on that investment’s market value. It can often take months to sell real estate properties, especially during periods of weak demand such as in a high interest rate environment. Liquidity risk can be largely mitigated through investments in high-quality real estate within popular asset classes such as residential, industrial, and data centers among others.

Execution Risk: Managing and maintaining commercial properties incurs costs and risks associated with property management, maintenance, construction, and regulatory compliance. The investor’s return on investment is contingent upon the manager’s ability to execute the proposed business plan, known as execution risk. Effective real estate investments necessitate diligent management to ensure a high-level of performance – achieving strong occupancy and prudent upkeep, safeguarding the investment’s value. The risk is dependent on the manager’s skill, ability to adapt to market changes, and operational effectiveness. Mitigation of execution risk can be achieved through managers known for their expertise in creating value through active asset management, strategic acquisitions, and operational improvements in the assets they control.

Financing Risk: Utilizing loans for commercial property investments exposes investors to risks associated with loan maturity, potential refinancing, and loan defaults. Financial leverage amplifies market and execution risk, with financing risk escalating as the debt level rises. Although financing risk increases with higher leverage, investors are often willing to incur this additional risk either because they have limited funds to invest and want to minimize their equity investment or because they desire the higher expected rate of return as part of their investment strategy. The extent of financial risk is influenced by the debt’s cost and structure. If an asset is financed and falls into hard times as user demand falters or operations fall short of the proposed business plan, the associated debt payments may limit cash flow available to investors, or worse, may fail to repay the lender and result in a total loss of equity.

Environmental Risk: Contamination or environmental issues on a property can lead to expensive cleanup and legal responsibilities. Changes in the environment or the discovery of potential dangers can notably affect the real estate value. For example, although asbestos was previously used for insulation, it is now recognized as a health hazard when found in buildings. Properties can also be contaminated by hazardous waste from spills or historical disposal on-site or nearby. Environmental risks can create a substantial financial burden, outweighing other risks, as investors might encounter cleanup costs that exceed the property’s worth.

Legal and Regulatory Risk: Changes in zoning laws, tax laws, or other regulations can significantly impact the value and profitability of commercial real estate investments. Real estate is subject to a myriad of regulations, including tax laws, rent control, zoning, and other restrictions imposed by the government. Legislative risk arises from the potential for regulatory changes to adversely affect investment profitability. For instance, the implementation of rent control or rent regulation can stifle market forces, impede revenue growth, increase compliance costs, and diminish the asset’s profitability and valuation. Variations in legislative stringency across state and local governments, particularly concerning new development, can further complicate real estate investment strategies.

When considering investing in a real estate project, it’s crucial to evaluate the potential return and compare it with other real estate opportunities and different types of investments. Analyzing risk differentials and premiums is essential in making well-informed decisions. Investors should carefully assess all factors before determining if the investment is justified.

Sign up to receive our latest insights and ideas directly to your inbox by subscribing to HCP Insights.

Interested in learning more about Hughes Capital Partners or our investment strategies? Connect with our team today.

Learn more about Hughes Capital Partners

Hughes Capital Partners helps clients navigate the complex world of private real estate investment. With a track record of effectively identifying risks and opportunities, we offer valuable insights to guide informed investment decisions. Our proactive, hands-on investment approach enables us to adapt to the dynamic landscape and deliver actionable strategies to help you reach your financial objectives. Connect with our team to learn more.

Related Education

Diversify Your Real Estate Portfolio

Investing in private commercial real estate (CRE) can offer numerous benefits; however, these investments carry risk. An essential aspect of mitigating these risks lies in the strategy of diversification and thorough due diligence.

Adding Real Estate to Your Portfolio

In today’s unpredictable markets, diversification is key. More than just a buzzword, diversification is a potent strategy that savvy investors employ to mitigate risks, and where better to start broadening your investment horizon than with real estate.

The Multifamily Housing Market

Multifamily housing, a key aspect of real estate investment, has been especially significant in the property market. It accounts for almost 25% of the U.S. commercial real estate market.

Start the Conversation

Committed to delivering institutional-caliber investment opportunities, strategy, and execution.